Ebola: Insurance sector assures competence in risks mitigation

As the dreaded disease, Ebola Virus Disease (EVD) continue to spread across West African countries with its attendant scourge on lives and economies, the need for insurance as a succor has been emphasized.

Medical practitioners among other workers are the most vulnerable, thus defined why they should be equipped with proper protections. NGOZI ONYEAKUSI weighs insurance sector’s readiness to offer this needed services.

Insurance sector since the dawn of the Ebola Virus Disease (EVD) in the country should be bracing up for more responsibilities, knowing fully well that as the disease first hit the medical sector, its effects should manifest in other sectors.

Insurance sector, being the risk bearers should be ready to mitigate circumstances surrounding the new development.

Insurance sector competence and capability

Interestingly, the sector has assured commitment and capability to face the new development. The sector said it has the financial and technical capacity needed for the business.

According to the Managing Director, Riskguard Africa Limited, Yemi Soladoye; “the Nigerian insurance sector has the financial and technical capacities to underwrite the risk”.

Soladoye, who is also a consultant to the National Insurance Commission (NAICOM), explained that it must be understood that insurance is both a commercial and social business hence granting life insurance cover to the medical practitioners is in their capacity.

He assured that the Nigerian life insurers are not just the highest capitalised in Africa, but also has the largest number of professionally qualified practitioners in the continent who have all it takes to underwrite the risk.

Corroborating with Soladoye, the Deputy General Manager,Life and Retail Operations, Union Assurance Insurance Plc., Nhamo Mawadza equally assured that insurance sector had the competence to offer both professional indemnity insurance, group life and others effectively and efficiently. He urged the government to provide the medical practitioners with some indemnity insurance cover, at least something they will fall back on.

But some experts are of the view that the sector should be cautious to avoid been swept out of business by huge claims likely to emanate from the risk. The sectors involvement in similar business in the past has resulted in some companies having their fingers burnt. This, obviously called for necessary business precautions .

Whom to insure

Before now, Nigerians were advised to procure different forms of insurance cover which will serve as protection against perils and other natural disasters as well as mitigate risks. The dawn of insurgency in the country had yet increased the level of awareness for life insurance and other forms of protection. Similarly, the arrival of the most dreaded disease in the country, EVD has definitely left Nigerians in the mercy of insurance. Consequently, insurance companies should weigh the health status of an intending policyholder, this will determine amount of premium to be paid by the client.

In his contribution, a Principal Researcher, Independent Insurance Researchers (IIR), Obinna Chilekezie opined that, ” in purchasing a life insurance cover, insurance companies have the right to request that the client go through a medical examination to know whether or not the person is qualified for the cover or what value of premium should be paid. So, for clients with serious ailments, they are either denied certain policies or are made to pay higher premium than those who are not suffering such ailment”.

Many consumers, he said are frustrated to learn that, in most cases, and may be declined due to pre-existing medical conditions. Only group plans, such as employer-sponsored health plans, and certain government-sponsored options provide guaranteed coverage for every person irrespective of their medical conditions.

A pre-existing condition is a health problem that existed or was treated before you applied for coverage under a new individual of family health insurance plan.

Certain serious conditions, including cancer, heart-disease or insulin-dependent diabetes, may result in an automatic decline by the insurance company. However, there are a number of other common medical conditions that may not necessarily prevent applicants from obtaining individual or family coverage”, he stated.

Soladoye in his view maintained that “Insurers can grant cover to ebola patients because in Kenya and South Africa, insurers grant cover to HIV positives. Ebola is an epidemic not a disease and so like cholera etc will soon pass. Even at that, insurers in other jurisdictions grant cover for existing deformities and dreaded diseases.”

Although he could not confirm whether any Nigerian insurance company is granting cover to HIV positives at the moment, but insisted that “no insurance industry can grow if the operators are only risk carriers by signboard but are risk averters in practice. Market growth and expansion can only come from unusual risks, new markets and underserved markets”, Soladoye insisted.

Likely premium hike

However, the growing scourge of the EVD is likely to lead to increase in the premium payable for life insurance cover. Though operators in the sector have been giving assurance that the sector do not have any intention of hiking the premium price as a result of the disease since there has not been claims experience arising from EVD.

According to the Director General Chartered Insurance Institute of Nigeria (CIIN) Kola Ahmed, premium hike is not likely to come soon as there has not been any known claims experience resulting from Ebola case that should lead to serious concern for rate increase.

Though, he said, he was yet to heard of any claim coming to the industry as result of Ebola case, but it should not be taken for granted.

“We at the Institute are conscious of the whole issue, and that was why we had to call of the Institute’s 2014 Picnic last Saturday in line with Federal Governments efforts to curtail the spread through much body contacts”.

Is Ebola a threat or opportunity?

Incidence of the EVD has no doubt been felt in all ramifications of lives in the World especially West African countries. Its outcome has indeed adversely affected economic activities across the globe. This development is seen by some insurance operators as big time opportunity while some believed it is a threat.

Soladoye, who opined that the spread of ebola would definitely have effect on life insurance depending on who is looking at it, stated that “While another underwriter will see it as a threat, I will see it as an opportunity and God knows within the next two months promised by our president to eradicate same, I would generate N4 billion from Nigerians. Insurance is generally a fear product and the fear is already here and not just at state or national level but sub-regional level- West Africa for a start.”

On the contrary, the President of the Nigeria Council of Registered Insurance Brokers (NCRIB), Mr Ayodapo Shoderu stated that the outcome of the disease will led to further drop in the insurance sectors contribution to Gross Domestic Product (GDP).

According to him, insurance sector will be negatively affected going by the possible rise in claims payment for life insurance which may emanate from the outbreak of the disease . ” Permit me to note that the scourge will also have adverse effect on the insurance industry going by the possible increase in compensation for life insurance.

Shoderu opined that it is a common knowledge that some countries are now restricting movement across countries adding that through such restrictions tourism and allied sectors have started to witness some lull in their operations.

He urged corporate bodies to join hands with the government to fight the dreaded disease. ” It is quite apposite for me to advice corporate bodies to collaborate with government in bringing an end to this monstrous disease.

He further stated that apart from creating unfriendly environment for productivity, the economies of nations most affected have been strained as substantial budgets made for other social and economic purpose are being diverted to curb the disease, already some critical sectors of West African countries of which Nigeria is cardinal are being affected adversely, he lamented.

” Permit me to note with utmost concern the outbreak of the Ebola which has continued to be a scary episode in the world, in view of its devastating effect on the human race as well as the e economic implication of its spread .

Nigeria was hit by EVD July this year when Patric Sawyer, a Liberian American first brought the disease into the country. EVD has killed about 1550 people in West African countries including Guinea, Sierra- leone, Liberia and Nigeria which are battling with the disease.

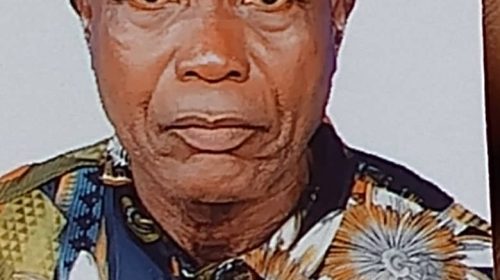

image credit: Doctors Without Borders

Culled from Peoples Daily Newspaper

Leave a Reply