Financial Inclusion: NAICOM Promotes Products Dev. For Excluded Groups

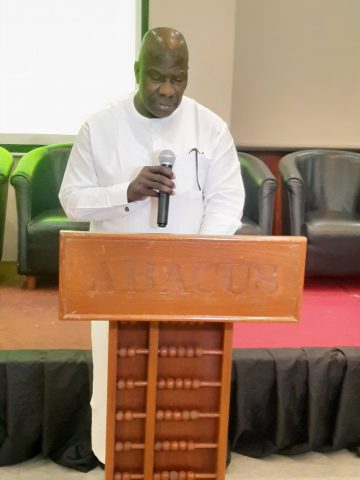

Commissioner for Insurance, Mr Sunday Thomas [/caption]

The National Insurance Commission, (NAICOM) said it is promoting the development of products and business models that meet the needs of the financially excluded group.

Commissioner for Insurance, Mr. Sunday Thomas disclosed this at a seminar for insurance journalists in Lagos at the weekend.

Speaking on the theme of the conference: “The Future of the Nigerian Insurance Sector in a Shifting Landscape,” Thomas said: The Commission is promoting the development of products and business models that meet the needs of the financially excluded group while ensuring automation of the Commission’s processes with a focus on actuarial capacity development programme and risk-based supervision regime.

“Furthermore, the insurance sector plays a vital role in financial inclusion because it reduces the poverty line, assist people to manage their risk and protect them from the negative adverse effect of any unforeseeable circumstances as well as increases access to other financial services.

“In today’s modern business environment, disruption plays an integral part of any business, hence innovation being implemented by the Commission is geared towards gaining control of a specific segment of the market that has been left untapped by encouraging the introduction of products tailored to the consumers in order to grow insurance businesses.”

He said the theme at this period of rejuvenation, “calls for the Nigerian insurance sector to develop innovative products and distribution channels, embark upon massive infrastructural development, improvement in social safety nets scheme, rejig business continuity plans and general deployment of technology to meet the expectation of today’s consumers and create new experiences that add value.”

The NAICOM boss said the Commission is encouraged to believe in a new dawn in all facets of regulatory policies, leveraging technological innovations, and a positive paradigm shift focused and poised to meet the anticipated surge in the demand side of the economy.”

Thomas stressed that the Commission is engaging stakeholders including state governments towards ensuring the domestication of the laws to ensure compliance with compulsory insurances and improve the business of insurance in their respective states.

He raised concern about some people who hold positions that are unknown to the commission in the various insurance companies, causing problems for and de-marketing the industry.

“Anybody that is not known to the Commission and is participating in a critical role in any of the insurance companies will be banned from participating in the insurance sector henceforth. We will make sure that the person does not participate in the insurance business in this country anymore,” he stated.

Leave a Reply