Universal Insurance To Hit N100bn Premium Income In Five Years

…I will leave legacy of virile company – Ujoatuonu

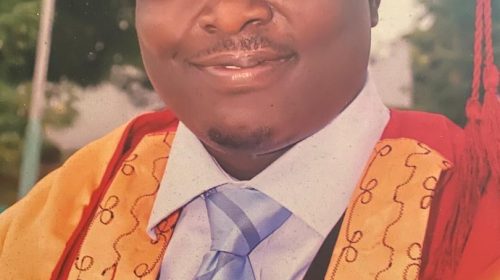

The Managing Director of Universal Insurance Plc, Mr. Ben Ujoatuonu has said that the company will hit N100 billion in premium income in the next five years following the trajectory that has been laid in the last three years.

Ujoatuonu, who stated this at the Annual General Meeting (AGM) of Nigerian Association of Insurance and Pension Editors (NAIPE) in Lagos, noted that his desire is to leave a legacy of a strong and virile company.

Ujoatuonu said: “If you look at our trajectory in the last three years, Universal insurance has consistently grown *her* premium income by 55-60 percent every year. If you take an average of the percentage growth on our premium income considering what we have done *so far*, in the next five years, universal insurance will be writing N100 billion in premium income. If we project a 50 per cent growth year on year, in five years, we will be writing N100 billion.”

Speaking on the legacy he wants to leave behind, Ujoatuonu said: “The legacy I want to leave in Universal is that I want to be remembered for having come in, transform Universal, and build a very strong and virile insurance company that has come to stay. That is the legacy I want to leave for Universal.”

The Universal Insurance MD noted that their experiences in bond insurance have helped to improve their underwriting skills around that risk.

He said: “The challenge in bond underwriting is subjective because it depends on how you understand the risk as it is not a rule of thumb and you learn as you go. We have had some experiences and those experiences have also informed and improved our underwriting skills around that risk so that if you come to our bond unit, there are some bond businesses you will bring, they will look at it on the face of it and will tell you that we will not do this. This is out of the experience that we have built over time and it has really helped us, so it is not what you close your eyes and do. We do thorough analysis and one of the key things about us is that for every transaction you do on bond, you must understand the dynamics of the business, if you don’t understand the dynamics of the transaction, there is no need going into it at all. If you already understand the dynamics you will be able to know where there will be problem, where defaults may likely come out from and it has helped us.”

Leave a Reply