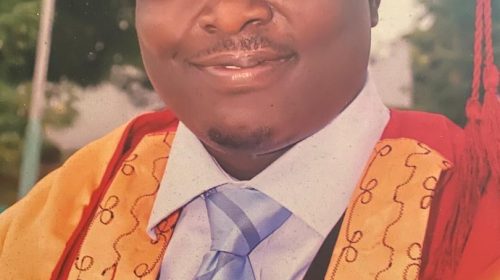

ADDRESS BY THE 26TH CHAIRMAN OF THE NIGERIA INSURERS ASSOCIATION AT A MEDIA PALEY IN LAGOS

Gentlemen and ladies of the Press,

I am delighted to stand before you today as the 26th elected Chairman of the Nigeria Insurers Association (NIA). I am deeply honoured by your presence and excited about the possibilities ahead of us as individual practitioners and collectively as an industry.

Our decision to meet with you before my investiture is deliberate. I appreciate your roles in shaping public discourse and resolutely advancing the cause of our industry. Our profession is greatly misunderstood; without you, we will achieve limited success in creating the necessary awareness that is required to improve the understanding of our policies, the principles of insurance, and the insurance profession. I also believe that you can be a source of feedback from our clients (and potential clients) on what we are doing well and the areas that require improvement. In a nutshell, distinguished ladies and gentlemen, you are our partners.

Allow me to also recognize and thank all the members of the Nigerian Insurers Association, particularly members of the Governing Council and insurance company CEOs, for trusting me to lead this Association.

The Current Landscape of Insurance

As we navigate a complex socio-economic environment in our country today, our insurance industry also finds itself at a critical juncture. Our nation’s challenges— from inflation to security concerns—are significant and have increased the risk profile of individuals and organizations.

However, these challenges equally present our industry with unique opportunities for growth and innovation. The recent increase in Foreign Direct Investment, which reached $3.3 million in Q1 2024, signals a renewed interest in our market. This is a moment for us to harness this momentum and reshape our industry for the future.

Incidentally, insurance is one of the solutions that can deployed to confront some of these challenges. Globally, insurance has proven to be a powerful tool for stabilizing economies, protecting investments, and providing the financial resilience that allows societies to thrive. However, in Nigeria, depending on your source of data, insurance penetration remains strikingly low. We currently lag far behind African and global averages despite being one of the continent’s largest economies.

Our Strategic Focus

To turn these challenges into opportunities for the growth of our industry and the prosperity of our nation, we will focus strategically on the following areas:

- Customer-Centricity: Enhancing customer satisfaction will be our priority. This will involve driving programs, initiatives, and policies to simplify the insurance onboarding process, improve claims handling, and ensure transparency in our operations. A satisfied customer is not just a repeat client; they will be the best advocates of our industry. We will implement best practices that prioritize the customer journey, ensuring that our clients always feel valued and understood.

- Digital Transformation: Our sector has historically been slow to adopt digital solutions. Moving forward, embracing digital innovation will be essential. We plan to launch an innovation challenge to invite solutions that streamline our processes and enhance customer experience. By collaborating with technology partners, we can reduce costs and improve service delivery, making insurance more accessible to all Nigerians.

- Commitment to Excellence: As we embark on this journey, I want to assure you that our commitment to excellence will guide our actions. We will focus on improving our claims processes, ensuring we fulfill promises and exceed expectations. The recent growth in claims paid—N536.5 billion in 2023—demonstrates our dedication to our clients. However, we recognize that there is more work to be done and will continue to improve the process to enhance the trust and confidence of our stakeholders.

- Advocacy and Collaboration: Engaging with government agencies to advocate for policies that support the insurance sector is essential. We will work diligently to ensure that insurance is integrated into national development plans. This includes collaborating on the Nigeria Insurance Reform Bill, which aims to modernize our regulatory framework and enhance the industry’s capacity to serve the public effectively

- Education and Awareness: Raising awareness about the importance of insurance is vital not just for our industry growth but for our economic development. We will expand our outreach initiatives, including educational programs in schools and partnerships with your esteemed media organization and institutions to disseminate information about insurance products and their benefits. We are convinced that by fostering a culture of insurance literacy, we can empower individuals and businesses to make informed decisions

Ladies and Gentlemen of the Press, our nation stands at a pivotal moment in its history. With the government outlining ambitious priorities for socio-economic transformation, there is an increasing need for industries that can support this vision. One such industry is insurance—an often overlooked but critical player in economic development. As we move forward, the role of insurance in de-risking vital sectors, driving financial inclusion, and creating a resilient economic framework cannot be overstated.

I am using this opportunity to call on you to join us at the NIA as we advance the cause of our sector to take its rightful place in Nigeria’s economic scheme of things.

Your role in communicating our vision and initiatives and advocating our cause will be even more crucial in this new dispensation. Together, we can reshape the narrative around insurance in Nigeria, highlighting its importance as a tool for social integration, risk management, and economic stability.

Thank you for your time, and I am looking forward to working with you all.

Leave a Reply