CITN Lauds FG’s Tax Policies, Reforms

BY NGOZI ONYEAKUSI

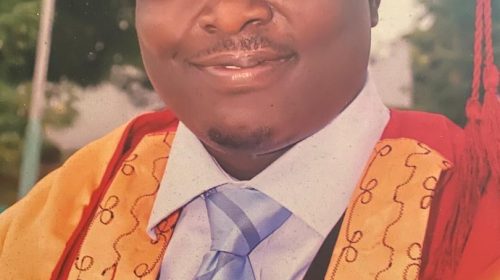

The President of the Chartered Institute of Taxation of Nigeria (CITN), Mr. Samuel Agbeluyi, has commended the Federal Government’s efforts to reform the country’s tax system.

Speaking at a media workshop Wednesday, for finance journalists, Agbeluyi noted that the government has demonstrated a strong commitment to overhauling the nation’s tax system, reducing dependency on oil revenues, and promoting fiscal stability.

Recall that there has been some contention raised about the recent tax reform ongoing in the domestic economy, and this include concerns about the impact of the proposed reforms on businesses and individuals. Some stakeholders have expressed worries that the reforms may lead to increased tax burdens, which could negatively affect economic growth especially in the Northern part of the country.

The bills are the Joint Revenue Board of Nigeria (Establishment) Bill, 2024; Nigeria Revenue Service (Establishment) Bill, 2024; Nigeria Revenue Service (Establishment) Bill, 2024 and Nigeria Tax Bill, 2024.

Northern governors have equally rejected the bills, describing them as anti-democracy.

Other key areas of worry includes;

– Tax Rates and Exemptions: Some argue that the proposed tax rates are too high, while others believe that the exemptions are too generous.

– Tax Administration and Enforcement: Concerns have been raised about the capacity of the tax authorities to effectively administer and enforce the new tax laws.

-Impact on Small and Medium-Sized Enterprises (SMEs): Some stakeholders fear that the proposed reforms may disproportionately affect SMEs, which are already struggling to comply with existing tax laws.

Meanwhile, the CITN President while welcoming the government’s efforts at reforming the tax system, urged stakeholders to base their assertions on facts and figures.

He highlighted the government key reforms and initiatives, to include

introduction of Executive Orders and Tax Relief Measures.

“President Bola Tinubu signed four executive orders in July 2023, which included significant tax relief measures, such as the suspension of the 5% excise tax on telecommunications services.

“Establishment of the Presidential Fiscal Policy and Tax Reforms Committee, which committee was inaugurated in August 2023 to address critical challenges in fiscal governance, revenue transformation, and economic growth facilitation.

“Fiscal Incentives for the Gas Sector, where the government issued a circular in December 2023, providing fiscal incentives for the gas sector, including import duty waivers and zero-rated VAT for key components and services.

“Deduction at Source (Withholding Tax) Regulations 2024, with the Minister of Finance issuing new regulations in June 2024 to clarify the rules for withholding tax deductions across various tax regimes.

Agbeluyi also commended the government’s efforts to make tax compliance easier and more flexible for businesses, citing the enhancements to the TaxProMax system and the implementation of a Tax Wallet feature.

The CITN President emphasized the importance of taxation in Nigeria’s economic development, noting that the Institute welcomes the government’s efforts to reform the tax system and address systemic challenges.

The major highlights of the media workshop was the paper presentation on, “Basic Taxation Terminologies, Tax Administration and Practice for Beginners and Tax Reporting for Media Practitioners.

The papers presentation where taken by the trio of Dr. Ismalia Olotu, Mr. Olumide Esan and Barr Chukwuemeka Eze respectively

Leave a Reply