CBN to deal with banks that charge customers for BVN …set to mop up N200 bn to check inflation

The Central Bank of Nigeria (CBN) yesterday said it will deal decisively with deposit money banks that charge their customers to register their Biometric Verification Numbers (BVN).

The apex bank, which described this fraudulent activity as a bottleneck to sector assured it will work to ensure that is removed.

This, among others is the fallout of the 323rd bankers committee meeting held yesterday in Lagos.

Briefing the press immediately after the meeting, Managing Director of Fidelity Bank Mr Nnamdi Okonkwo said there was discussions on issues that could jeopardise financial inclusion and anything that would stop people from being included in the formal financial sector.

“One key issue that came up today is the issue of customers of microfinance banks, MFBs who do not yet have their Biometric Verification Numbers registered, BVN. Some feedback that the committee got was that some banks charge customers when they try to register. So the bank’s committee agreed today that mfbs customers can walk into any bank and register their BVN free of charge, to make sure that we don’t discourage people from being financially included.

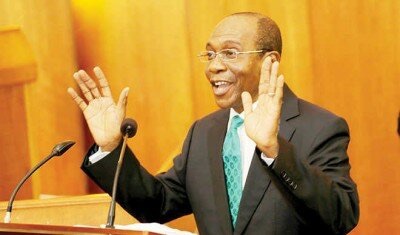

Also speaking, the Acting Director, Corporate Communications Department, CBN, Isaac Okorafor, equally disclosed that the apex bank in a bid to check inflation in the country, has unveil plans to mop up a total of N200.32bn from the banking sector.

According to him, the decision to mop up liquidity was in reaction to the maturity of N206bn on Thursday, June 15, 2017.”

Okorafor explained that the amount would be mopped up through a special Open Market Operation at the rate of 16 per cent per annum.

Okorafor explained that the rate of 16 per cent per annum was agreed at the meeting due to the falling rate of inflation, which he noted would continue to decline.

Open market operation refers to the buying and selling of government securities in the open market in order to expand or contract that amount of money in the banking system and is facilitated by the CBN.

“In a move to further rein in inflation, the Central Bank of Nigeria has unveiled plans to mop up a total of N200.32bn from the Nigerian banking system through a special Open Market Operation at the rate of 16 per cent per annum.

The CBN had on Monday released its Treasury Bills Issue Programme for the third quarter of the year in which it disclosed that the maturity dates for the various tenors would be June 15, June 22, July 6, July 20, August 3, August 17 and August 31, 2017, respectively.

Leave a Reply