Welcome Address By The Principal Consultant, Carefirst Consult, Gus Wiggle At 2022 Claims Advocacy Confab In Lagos

Good morning Insurance Stakeholders, Members of the Press, Ladies and Gentlemen

I welcome you all to this maiden edition of our Annual Insurance Advocacy Conference with our theme for this year “Catalyzing Insurance through better Claims Experience”. I welcome most particularly the consumers present here today without whom we will not be gathering here today.

I will also like to make a special recognition of the press here today, whom we have come to recognize as partners in our attempt to deepening, disseminating and educating the public in understanding insurance with its attendant benefits and the providers meeting the expectations of the consumers.

This morning, we are gathered here to discuss that perception or otherwise that there is so much or little distrust between the consumers and the insurance companies.

We shall be hearing from all stakeholders – the insurance companies, the consumers of insurance products, the intermediaries that is the brokers and loss adjusters and try to understand where this distrust emanated from or it’s just an imagination.

With customer expectations and insurance companies drive for retention, one way to which both can work is to delight customers with service delivery and the company going extra mile to stand out from the crowd to rake in extra clients.

CAREFIRST CONSULT is a Claims Management outfit who has come to fill a void in the insurance ecosystem and add to the value chain of insurance. We desire to be a leading provider of claims management, recovery services, arbitration and Risk Management Consultant in the country.

We envisioned to improve the insurance experiences of policyholders and enhance the public perception of the insurance industry in Nigeria with regards to claims management.

CAREFIRST CONSULT seeks to assist victims and their families manage the processes to minimize the emotional stress that set in and ensure compensations are timely and appropriate.

Our Value Proposition

Our team has professionals of diverse background and expertise who have participated in research work on claims administration and management in Nigeria prior to setting up Carefirst Consult.

The insurance industry faces huge trust deficit from the public arising from the horrifying stories that policyholders with claims share, to the extent that those who do not have policies tell the stories even more and better.

Addressing the outstanding claims of individual policyholders became more challenging when the policyholders complained to the regulator, National Insurance Commission (NAICOM), yet have had to wait for their payments, sometimes for over one year.

When will NAICOM be coming hard on insurers who unduly delay claims or not paying at all? Is it out of place to publish the names of insurance companies who are defaulting in payment of claims particularly after they have executed Discharge Vouchers upward of three months to send a single to the weak companies to wake up or pack their bags and leave the stage for the real actors to deliver services they have promised their consumers.

Has Brokers and Loss Adjusters helped to alleviate the pains of the consumers in time of claims or added to it?

One of the 5 strategic goals of NAICOM is “improve trust and confidence in the insurance sector

I hope the discussions we will have today will confirm if this goal has been achieved or its work in progress or no movement at all.

Carefirst Consult can be called a child of circumstance. Just after the #endsars riot, a friend approached me after his building was burnt by the rioters.

He narrated how an insurance company whom he has been paying his premium half yearly declined to pay his claim even when the premium he has paid covered the period of the incident.

All the company told him was that the contract policy never indicated the premium will be paid on installment basis but annually and therefore he has breached the policy condition, meanwhile this arrangement had been going on for some years, they didn’t find fault in it as it was convenient for them then.

The long and short of the story, people of goodwill intervened and the claim was settled.

We have insurance companies asking for police report for a lone accident with an estimate of repairs of N250k.

Knowing that getting police report does not come cheap, the insured victim will have no choice but to abandon the claims knowing that paying the cost of the police report is almost as the cost of repairs of the accidental vehicle.

I ask, must every claim dispute end in the court? What about the Arbitration Clause in every policy, how much have we used in-depth analysis?

Effective dispute resolution enables parties to resolve cross-border disputes quickly and to get back on track.

This is not to say insurance companies don’t pay claims, in 2017, 2018, 2019 and 2020, the insurance companies paid N142.8B, #193.5B, #206B and #224B respectively.

Why are insurance companies not celebrating their claims payment to the public under the wave of people saying they don’t pay claims? If you don’t blow your trumpets, who will blow it for you?

We are willing to help insurance companies publish their claims on our website if we are not asking for too much as our own way of improving trust and confidence in the insurance sector

What we want to offer those that engage our services are

Peace of mind

Trust

Respect

Humility

Tolerance

Perseverance

Believe

Consistency

Love

Carefirst Consult will ensure that the right amount of reimbursement is paid based on the client’s loss.

Our job shall include processing and reviewing the claims made against the insurance company.

We are responsible to recover denied claims

.

Our Future

CAREFIRST CONSULT is poised to be the preferred assisted platform that would offer insurance policyholders a reasonably transparent process to achieve one of the strategic goals of NAICOM to “improve trust and confidence in the insurance sector” and enable growth in the number of Nigerians with insurance policy by making sure all genuine claims are paid promptly.

We shall be the new watchdog for policyholders against insurance companies that want to deny or delay all genuine claims.

Let me on this note thank very especially all the organizations who have supported this conference with their financial resources despite the late notification and end of year activities.

I wish you all a pleasant time as we discuss issues that bother on claims management; and the consumers and their insurance companies.

Thank you.

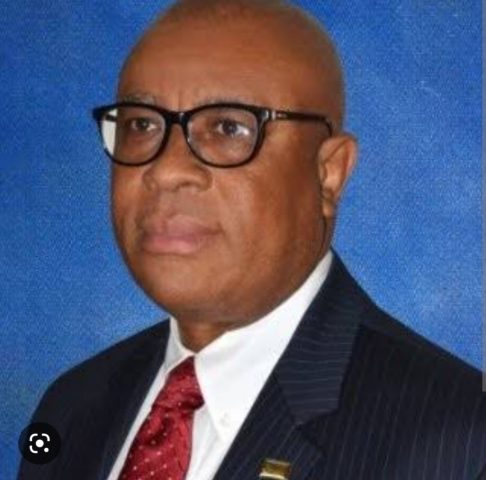

Gus Wiggle

Principal Consultant

Leave a Reply