Insurance Industry Must Invest In Human Capital Development For Change — Igbiti

In a bid to ensure that insurance industry take its pride of place in the scheme of things, ensure adequate penetration and contribution to GDP, it must take as priority investment in the human capital development.

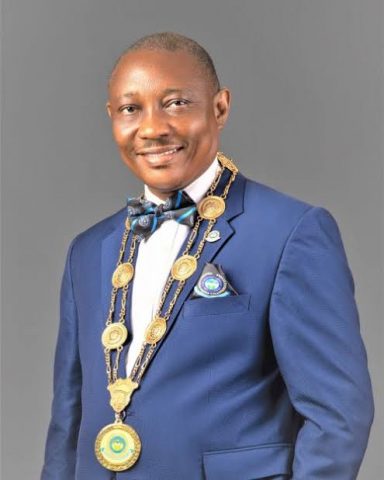

The President and Chairman of Council, Chartered Insurance Institute of Nigeria (CIIN) Mr Edwin Igbiti stated this at the

its 2023 Business Outlook conference in Lagos, even as he urged insurance firms to take as priority capacity building of their workforce to propel growth.

He noted that the institute which has empowered over 50 young insurance millennial leaders was committed to that adding that growth of the insurance industry could be hampered if the industry is not investing in human capital development.

He regretted a comment by one of the discussants at the forum who submitted that he didn’t partake in any form of training while serving his organisation as an insurance practitioner.

Welcoming key industry players and financial sector experts, Igbiti opined that the conference was specifically designed to review the business environment in the country for immediate past year and strategies on the way forward for the insurance industry in the new year.

According to him, This programme among other things, examines the national budget, reviews the thrusts of the fiscal and monetary policies of government and estimate how these would influence the insurance industry in particular and the economy in general.

This first session of the review envisages the 2023 national budget, most especially the aspect that relates to the Insurance Industry and how the industry can reposition itself.

The objective is to review business and financial activities, share ideas, project proponents for profitability and proffer solutions and recommendations to operational challenges in the country.

“It is a platform to discuss the National Budget as it relates to the financial sector, meet professionals from different professions in the financial world and share expertise on the issues pertinent to the growth and development of the Nigeria economy.” he said.

He appreciated the Commissioner for Insurance for always answering the Institute’s calls whenever they reach out and doing so with the zeal, dexterity and commitment that defines true professionalism.

Leave a Reply