40 per cent Of Our Initial Customers Are Non Muslims — Hilal Takaful

By Ngozi Onyeakusi—The Managing Director/CEO, Hilal Takaful Nigeria, Thaibat Adeniran, has reiterated that Takaful Insurance is not solely for Muslims, but designed to cater for needs of the insuring public.

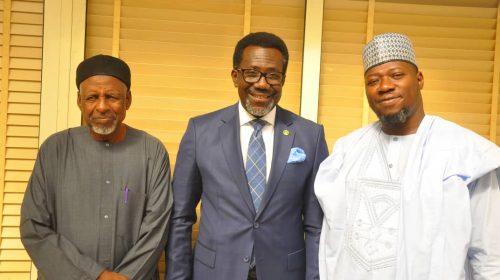

Speaking today, when members of Insurance and Pension Editors of Nigeria (IPEN) paid a courtesy visit to the firm in Lagos, Adeniran assured that Halal Takaful Nigeria, provide robust insurance covers for Muslims and non-Muslims.

According to her, the firm at inception had 40 per cent of policyholders as non-Muslim, adding that presently the number has increased tremendously.

She noted that what attracts customers to Takaful products is not religion, adding that customers embraced the products because the products meet their needs.

“So that is a plus, when you work the talk and realise its non-Muslims that appreciate our products most”, she said.

Adeniran hinted that non-Muslim were their first clients at inception, stressing that people from different faith show interest in Takaful products in as much as it was presented in truth and sincerity.

Speaking on claims payment, she stated that Hilal Takaful Nigeria, settled claims worth N220 million in the 2022 financial year, while it paid N50 million in the month of June 2023.

On surplus payment, she assured that Hilal Takaful has been consistent in surplus payment, which according to her is calculated and paid to customers who were not paid claims within the financial year.

She noted that customers of Takaful are always excited to receive the surplus pay at the end of the year.

Also speaking the President of IPEN, Chuks Udo Okonta, expressed delight on the performance of Halal Takaful Nigeria and pledged that the group would support the firm in meeting its goal of providing enriched insurance products and services to the insuring public.

He noted that IPEN consists of developmental focused journalists, who are committed to the growth of insurance and pension sectors.

He said the group as part of its developmental initiatives, has being engaging stakeholders in the insurance and pension sectors to engender contributions that would sustain the growth of the sectors.

Okonta told Halal Takaful that the group had in the past had engagements with shareholders; insurance brokers; insurance agents; policyholders, adding that there are plans to also engage more insurance consumers to ascertain from them how they feel insurance and pension operators can serve them better.

He also informed the company of future plans of the group, whilst craving a robust relationship with the company.

Leave a Reply