NDIC Strengthens Liquidation Activities, Debt Recovery Rate

By Ngozi Onyeakusi—The Nigeria Deposit Insurance Corporation (NDIC) has assured that it has strengthened its liquidation activities, and greatly increased its debt recovery rate leading to the declaration of 100 per cent liquidation dividends to depositors of over 20 deposit money banks in liquidation.

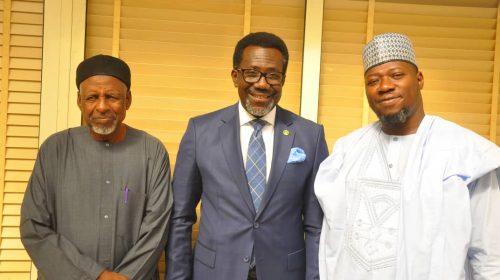

Declaring open the 2023 Finance Correspondents Association (FICAN) workshop in Owerri, the Imo State capital, the

Managing Director/Chief Executive Officer of NDIC, Bello Hassan stated, “The corporation has also enhanced our systems, processes and procedures to promote transparency and accountability in our operations, amongst other humble achievements”.

He added “It is therefore a welcome development to us that the Corporation has been identified for various special recognitions and awards amongst the comity of ministries, departments and agencies (MDAs) by credible bodies and institutions.

Some of the awards are, “Year 2021 and 2023 Overall Best Public Institution among 360 MDAs in the Independent Corrupt Practices and Other Related Offences Commission’s (ICPC) Ethics and Integrity Compliance Scorecard (EICS), first position in the 2021 Transparency & Integrity Index, a public sector assessment by the Center for Fiscal Transparency & Integrity Watch (CeFTIW), a non-governmental and non-partisan organization established in 2016 and supported by the MacArthur Foundation to promote accountability and transparency within the public sector; among others.

Hassan added that these recognitions bear eloquent testimonies to the irrevocable commitment of the

current Management Team of the NDIC and the staff, to bring about a

paradigm shift in the discharge of the Corporation’s mandate.

“It is therefore, my sincere hope that the discussions at this forum would go a long way to strengthen our resolve, for a more robust implementation of the deposit insurance system in Nigeria, to complement the Central Bank’s efforts in strengthening the safety, soundness and stability of the financial system”.

The NDIC boss added that the corporation has also introduced the Single Customer View (SCV) framework that has enhanced the speedy payment of insured sums to depositors of closed banks.

He said, “We have enhanced collaboration with the bar and the bench, leading to speedy dispensation of justice and more informed judgments on failed banks cases; we have equally put in place policy and framework on Alternative Dispute Resolution for out-of-court settlement, which had enabled us to resolve some hitherto protracted failed bank litigations; we have reviewed the Framework for Differential Premium

Assessment System (DPAS) to make it more risk-sensitive and account for

significant developments that have taken place in the Nigerian banking system since its adoption in 2008; and we have established a special desk at the Economic and Financial Crimes Commission (EFCC) which has

energized investigation and prosecution of parties responsible for the failure of banks.

“The corporation has also reached an advanced stage in the review of the maximum deposit insurance coverage, to account for the impact of

macroeconomic developments, since its last review. We believe that the

new coverage level once approved will go a long way in reinforcing depositors’ confidence in the NDIC’s deposit guarantee scheme”.

He said the desire to strengthen banks through prudential thresholds and other regulatory instruments, calls for

collaboration with all relevant stakeholders in the Nigerian financial system

It is this background that informed the choice of this year’s FICAN Workshop

theme: “Stocktaking of Deposit Insurance Practice: Assessing the

Past, Evaluating the Present and Forecasting the Future”, Hassan said.

Leave a Reply