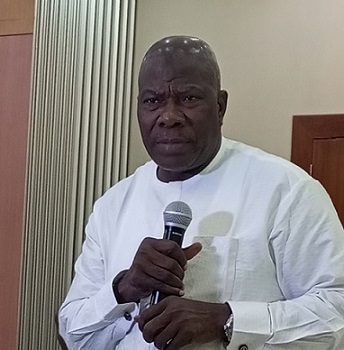

Keynote Address by the Commissioner for Insurance at the Mettlehouse Consulting IFRS 17 Insurance Industry Roundtable held in Lagos

It is truly a privilege for me to have been invited to give a keynote address at this IFRS 17 Insurance Industry Roundtable that is aimed at among others recommending best practices for harmonisation, comparability and consistency of expense allocation, especially as it relates to insurance service expense, in the insurance industry in Nigeria.

I warmly congratulate the Mettlehouse Consulting for this great initiative and gathering distinguished presenters, panellist and participants to discuss on a great topic titled “Resolving Insurance Service Expenses Allocation Challenges in Financial Reporting under IFRS 17”. I equally, specially welcome all the distinguished participants present at this great gathering for their sacrifice to honour and participate at this program despite their tight official schedule, as I know that this is not the right period for calling out Accountant from office as they are fully engaged and busy with the annual audit of their financial statements. I greet you all.

The topic for our discussion is of utmost significant in the realm of insurance accounting and financial reporting as the adoption of IFRS 17 represents a paradigm shift in the accounting standards for insurance contracts, and its implementation has presented the industry with formidable challenges, particularly in relation to the allocation of insurance service expenses.

We thank Mettlehouse Consulting for willingness to supporting the insurance industry in its IFRS 17 implementation which they have started with the identification of this significant challenge currently faced in our industry and gathering this distinguished personalities to proffer recommendations to achieve transparency, comparability and consistency in financial reporting by our insurance operators in Nigeria.

We all know that the IFRS 17 has fundamentally transformed the way insurance contracts are accounted for as it introduced a principles-based approach that aims to improve transparency, comparability, and consistency in financial reporting. While the overarching objective of IFRS 17 is commendable, the practical implications on expenses allocation have posed intricate challenges for insurers Worldwide. This Roundtable therefore, presents a timely opportunity for us to engage in collaborative discourse and share insights on navigating the complexities of the insurance service expenses allocation under IFRS 17.

Resolving the insurance service expense allocation challenges in financial reporting is an imperative endeavor that necessitates strategic realignment and driving by a proper board approved policy. Although, I still recognise individual entities peculiarity that plays a pivotal role in their expenses allocation, but as a regulated industry, the Commission is committed to the harmonisation of financial reporting practices among our licenced insurance operators in Nigeria to achieve comparability among the industry players as this remain one of the key objectives of IFRS 17.

Therefore, in our deliberations today, I encourage each of you present to draw upon your expertise and experiences to delve into the practical complexities and intricacies surrounding the allocation of service expenses under IFRS 17 and possibly proffer solutions that will enable us as industry achieve one of the cardinal objectives of IFRS 17, which is comparability.

It is my fervent hope that our discussions today will yield actionable strategies and recommendations to address the challenges posed by the allocation of service expenses under IFRS 17. By leveraging on the collective wisdom of this esteemed gathering, we can surmount these challenges and contribute to the advancement of financial reporting practices within the insurance industry in Nigeria.

Distinguished ladies and gentlemen, on that note, I hereby declare open this maiden edition of our IFRS 17 Insurance Industry Roundtable – Series 1 open and wish you all fruitful deliberation in your various discussion.

Thank you and God bless.

Leave a Reply