Sterling Bank empowers female entrepreneurs

In a bid to empower women operating in the Micro, Small Medium Enterprises (MSME) sectors of the Nigerian economy, Sterling Bank Plc, your One-Customer Bank, organised a capacity building to equip them with competencies required to run a better business. The programme was powered by One-Woman, the bank’s robust and exclusive value proposition for women.

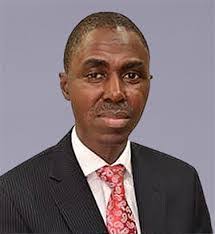

Commenting on the capacity building programme, Cosmas Uwaezuoke, Head of Retail Sales, Sterling Bank Plc said “The bank is committed to equipping female entrepreneurs with business skills and financial management competencies required to run better businesses. We are doing this because research shows that women own 41 percent of businesses in Nigeria. However, just about two percent of women entrepreneurs have access to finance, that is bank loans. To change this trend, we are teaching female entrepreneurs to enhance profitability through effective cash flow and working capital management.”

According to Mr. Uwaezuoke, a research conducted by Enhancing Financial Innovation & Access (EFInA) indicates that women constitute about 47.5 per cent of Nigeria’s population. However, just 30 per cent of women have bank accounts even though it is estimated that there are more women doing businesses than men in the country. “Research shows that women want convenient banking services, safety of funds, access to finance and capacity development as well as savings opportunities for their children.”

Mr. Uwaezuoke observed that it was against this background that Sterling Bank, one of the top five SME friendly banks in the country, created the ‘One Woman’ proposition to meet these important financial services needs of Nigerian women.

Explaining the One Woman value proposition, Mr. Henry Bassey, Chief Marketing Officer, Sterling Bank Plc said, “It is a bouquet of value-added offerings which meets the financial, business and personal needs of Nigerian women, irrespective of their social status. The One Woman value proposition also provides very strong platforms for women to support other women.

Mr. Bassey disclosed that benefits of the One Woman value proposition range from Sterling Maternal Medical Finance (SMMF) for women with medical conditions such as fibroid, customized debit cards that provide cardholders access to discounts for spas, makeover services and furniture/household items at select outlets. Other benefits include discounts on lending rates of all existing retail loan products (e.g. personal loan, asset acquisition loan, MSME loans,) for women and free access to capacity building programmes.

Leave a Reply